- QUICKEN VS MONEYDANCE FOR FREE

- QUICKEN VS MONEYDANCE UPDATE

- QUICKEN VS MONEYDANCE MANUAL

- QUICKEN VS MONEYDANCE LICENSE

- QUICKEN VS MONEYDANCE DOWNLOAD

QUICKEN VS MONEYDANCE FOR FREE

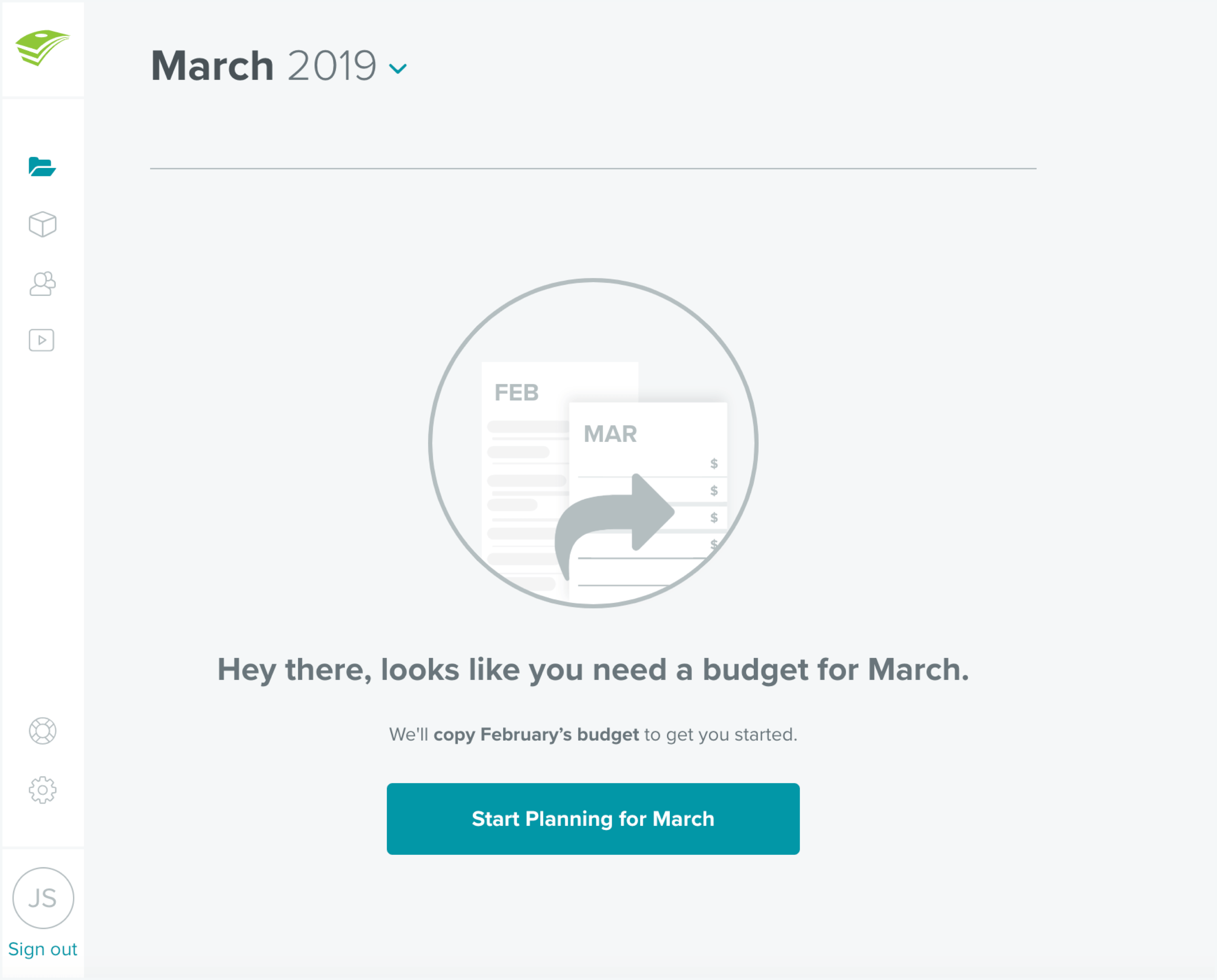

Try the full software for free for as long as you want (with a trial reminder message).Local software and file storage (no cloud storage or software-as-a-service).Lightweight budgeting (maybe too lightweight, depending on your needs).I recently discovered Buckets, which I found to meet a lot of my goals, and may meet some of yours. Posted by NumberSix at 9:54 PM on January 3, 2019 It's not perfect, and other applications might suit others' needs more, but it's a great fit for me in terms of features and feel.

QUICKEN VS MONEYDANCE LICENSE

Buying a license lets you use MD on as many computers and platforms as you own, and the one-time purchase price means you don't have to pay to keep using it. The online forums and help pages are full of helpful tips from users and responses from the developers. I'm happy to pay for software that's so useful to me and so well-maintained. The data is just between me and my banking sites. However, none of my data ever passes through them.

Yes, Moneydance is produced by a company that's for-profit. I only use it to categorize transactions and match payments, but there are a lot of other features.

QUICKEN VS MONEYDANCE UPDATE

There's usually a MD update soon after that fixes it, and the option of manually getting the data files and importing them has gotten me through the downtime.

That's usually pretty smooth, but about once a year there's some glitch on the provider side (I vaguely recall it being related to either Java updates or changes to the Quicken version that the banks require & MD has to emulate) that blocks the process. I do use its feature for downloads of transactions from my credit union & credit card issuer. Posted by quinoa at 12:02 PM on January 3, 2019 I would still be giving my data to a for-profit, but I feel so iffy about Intuit/Quicken that I might prefer to be working with an alternative product. + Check out Moneydance, if I have the time, consider it as another alternative to Quicken. Remove/hide data for accounts which I've determined I don't get value from tracking. I suspect I'll decide to stick with Quicken, based on my first test run mini-import described above, but at least I'll know I gave it a real try.

QUICKEN VS MONEYDANCE MANUAL

+ At end of January, do the manual import of accounts (for 8 active accounts, including a couple credit cards, and checking/savings accounts) into Gnucash and Quicken, see how painful it is. So I have decided to minimize my work (and maximize my time available for other things in life!) by only doing the pieces that actively improve things, by allowing me to track my spending. I don't get much value out of that.except the sense of satisfaction of "it reconciled!" or "it's all complete and in one place!" and I can let go of that, it's not really where I want to put my attention. And I can skip the step of entering paycheck detail, tax lines, and so 's all available on the paystubs if I need it later. The others, like some laddered CDs I have, I don't really need to track in a separate system. I really only need to track transactions related to expenses, and I only need to track my actively-used accounts. + I've also realized that I have been tracking more than I need to. Unfortunately, neither Quicken nor Gnucash is particularly good in this area. + In addition to the issues raised above, I also have some assistive technology needs, so I prefer options with less typing required, where I can use keyboard shortcuts and Dragon NaturallySpeaking. I'm going to have to decide if the extra time spent on the computer is worth the trouble. It appears that the process of classifying the accounts is quite manual in Gnucash. + I did a test run mini-import for my main active checking account, just for January 1-2, into both Quicken and Gnucash. + The Gnucash process for importing transactions also involves downloading account-by-account, and then importing account-by-account.

QUICKEN VS MONEYDANCE DOWNLOAD

+ It seems that if I don't do the "One Step Update" in Quicken, and I instead download transactions from the bank websites account-by-account as a QFX file, and then import them into Quicken myself, that would avoid the privacy issue of me giving Intuit/ Quicken all my data. Getting this input, and talking through the issue with others IRL, here's where I'm at (since some of you sent DM asking): Response by poster: This is all been really helpful.

0 kommentar(er)

0 kommentar(er)